The higher standard deduction has some people thinking they can handle their own personal income-tax preparation. They may want to think again. For instance, you can’t use the standard deduction if you’re...

Leave Excess Retirement Savings For Grand-Children Without A Big Tax BillNaming grandchildren as beneficiaries of traditional IRAs used to be a popular estate-planning strategy. Grandchildren had their lifetimes to empty an inherited IRA, which also let them stretch out income-tax payments on the assets...

Yes! You Owe Tax on ThatIf something of value changes hands, you can bet the IRS considers a way to tax it. Here are six taxable items that might surprise you...

Moves to Improve Your Credit ScoreWhile your credit score is a three-digit number that's automatically assigned to you, this is one area of your financial life where you have quite a bit of control. The moves you make or don't make with your credit can help determine where this score falls at any time, and the impact can be dramatic...

Avoid a Penalty and Tax Surprise when Withdrawing from Retirement AccountsRetirement accounts that provide tax breaks have very specific rules that must be followed if you want to enjoy the financial rewards of those tax breaks...

SERVICES

RECENT E-NEWSLETTERS

FEBRUARY 2024 Q & AQ: As an employee-retention move, is there any tax-advantaged way I can help my employees with their student debt? A: Consider implementing a qualified education assistance program to pay part of employees’ student loans. Now, through 2025, you can pay up to $5,250 a year per employee to help them make student loan payments and receive a tax deduction for your payments. This amount is excluded from employees’ income. Plus, under a new law in 2024, you can offer matching 401(k) contributions to employees based on their repayment of student loans. Participation is voluntary, and employees must opt-in.

Check Before DonatingWhatever your charitable passion, you can find an organization supporting it. But how do you determine whether an organization is legitimate? RED FLAGS Watch out for these scam signs:

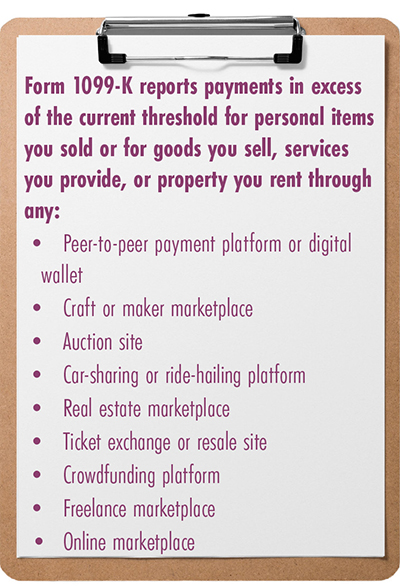

IRS Delays Online Sales RuleIn an unexpected move, the IRS has postponed enforcement of a 2021 American Rescue Plan provision affecting self-employed people who earn money on third-party platforms like eBay, AirBnB, Etsy, VRBO or have payments processed by services like Venmo and PayPal. The provision would have required these platforms to report gross payments of $600 or more to you and the IRS in 2023. Now, for 2023 tax filing, the previous reporting threshold of more than 200 transactions per year exceeding an aggregate amount of $20,000 remains in effect. The provision does not change what counts as income or how tax is calculated—just what the online platforms have to report to the IRS. You must still track and report your online sales and services income. Your tax professional can tell you more.

|