You Need Tax Planning If...Life can alter your taxes with little to no warning. Here are several situations where you may need to schedule a tax planning session...

Start Your College Grad on the Path to Becoming a MillionaireYou may be able to do this utilizing any unused funds in the student’s 529 Plan. The IRS now allows rollovers of these funds to a Roth IRA in the child’s name...

Independent Contractor Rules UpdatedWhether you use independent contractors in your business or are an independent contractor yourself, take note of recent Department of Labor (DOL) changes in the Fair Labor Standard Act’s (FLSA) rule for determining independent contractor status — and the consequences of misclassification...

Prepare Yourself Financially When Purchasing a VehicleFinancing a new or used car could spell big financial trouble if your vehicle is ever declared a total loss – even if the accident is 100% the other driver's fault. Here's what you need to know about staying safe financially if you take out a car, truck, or SUV loan in the future...

Get Sanity Back...Ideas to Unplug This SummerDuring your summer break or vacation, consider the following ideas to not only recharge, but to do so without sitting in front of a screen, monitor, or phone...

SERVICES

RECENT E-NEWSLETTERS

JUNE 2024 Q & AQ: I’m fairly new to investing and am thinking of branching out from mutual funds. What can you tell me about exchange-traded funds? A: Simply put, an exchange-traded fund (EFT) is a basket or bundle of individual securities that track an index, sector, commodity, or other assets. Unlike their “cousin” mutual funds, EFTs are marketed on a stock exchange like stocks. They may contain a single investment type or be a mixture, including stocks, commodities, bonds, or currency. Some ETFs offer U.S.- only holdings, while other may include international securities. ETFs have low expense ratios and are generally less costly than buying the stocks individually.

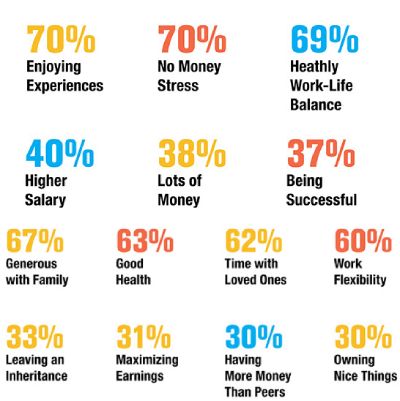

Do You Feel Wealthy?

Making it into the millionaires’ club isn’t what it used to be, at least according to data from an online study by Logica Research in 2023. The respondents, who had a mean household income of $93,000 and median income of $68,000, said that $2.2 million in personal net worth was needed to “be wealthy”. Paradoxically, about half of those same individuals reported feeling well off with an average net worth of only $560,000. The chart summarizes how 1,000 survey respondents across America described what wealth means to them. Clean Out Your SubscriptionsYou may be so used to seeing recurring charges on your monthly statements that they don’t register as the unnecessary expenses they may be. Do you use those services enough to warrant paying for them? Eliminating those fees can result in sizable savings over time. GET STARTED Look at your credit card and bank statements and what you’re spending on things you no longer use. Question anything you don’t recognize. If you don’t see how to unsubscribe on the company’s site, search the web, call customer service, or check with your credit card company's customer service. GOING FORWARD Turn off the auto-renewal option when you subscribe. If you opt out, the company has to contact you before charging your credit card. Read the fine print on special offers. For example, opt out before a lower promotional fee ends.

|