In 2021, Congress passed the Corporate Transparency Act (CTA). This act represents a significant change in the regulatory landscape for ALMOST ALL entities doing business in the United States. The primary goal of the CTA is to enhance corporate transparency and combat financial crimes such as money laundering and the financing of terrorism...

Watch Out for These Tax MythsHere are several tax myths that if you believe them, could leave you with an expensive tax surprise.

Avoid Sneaky Fees Draining Your Bank AccountSneaky, fees are finding their way into things we buy every day. Here are some common fees you may encounter and what you can do to avoid them altogether.

Take an Active Roll in Your FinancesResearch on women and finance has revealed a few paradoxes. Although, on average, women earn better investment returns than men while taking less risk, men's 401(k) balances are generally 50% larger than women's. Younger women have narrowed that gap to about 23%.

Paying Taxes When You're Self-EmployedWhether you have just started a side hustle or have been freelancing for years, filing taxes can present challenges. Here are some points to keep in mind.

U.S. Citizens Give GenerouslyAmericans gave an estimated $557.16 billion to U.S. charities in 2023, according to Giving USA 2023: The Annual Report on Philanthropy for the Year 2023 (from the Giving USA Foundation, the Giving Institute, and the Indiana University Lilly Family School of Philanthropy). The total includes charitable contributions from individuals, estates, foundations, and corporations.

SERVICES

RECENT E-NEWSLETTERS

NOVEMBER 2024 Q & AQ: I have a life insurance policy that names my son as beneficiary. Should I also include this policy in my will? A: It wouldn't hurt anything, but no, you don't. That's because life insurance beneficiary designations take priority over terms of a will, even if they differ. The same holds true for the beneficiary designations of retirement plans and annuities. This is a good time to remind you that keeping all your beneficiary and contingent beneficiary designations current would be best. If you're interested in your beneficiaries getting the most from the benefit without triggering estate taxes, or you want to avoid the public glare of probate, you might consider putting the life insurance policy in a trust.

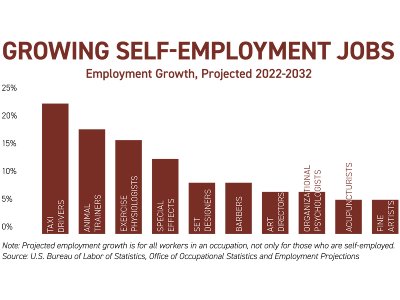

How to Take Tax Friendly RMDsBefore you retire, consider planning for your required minimum distributions (RMDs). This can be more complicated than you imagine if you have significant retirement assets in qualified plans, but with a little planning, you can achieve a tax-friendly result. KNOW THE RULES CONSIDER THESE MOVES Growing Self-Employment Jobs

This chart show the expected employment growth in the various occupations from 2022-2032. Note: Projected employment growth is for all workers in an occupation, not only for those who are self-employed. Source: U.S. Bureau of Labor Statistics, Office of Occupational Statistics and Employment Projections

|