What You Need to Know About the Corporate Transparency Act (CTA)In September 2022, the final rule implementing the Corporate Transparency Act (CTA) was put into effect by the Financial Crimes Enforcement Network (FinCEN). The rule puts into place a series of new requirements for millions of businesses around the United States to ensure they disclose the beneficial ownership of those companies. Here is what you need to know about the Corporate Transparency Act...

Common Tax QuestionsWhat everyone is wondering During tax season, there are a number of areas that generate questions. Here are five of the most common and their answers. But like most things, there can be exceptions, so if in doubt always ask for help.

Surprise Bills: Prepare Your Business for the UnexpectedGetting a bill for an unexpected expense can put a dent in your business’s cash flow. Here are some tips your business can use to handle these unforeseen bumps in the road...

When Should You Start Social Security Benefits?Before deciding to collect Social Security benefits, consider these tips to help you make an informed decision.

Legal Documents Most Americans NeedThese documents will give your family guidance and comfort when they need it most.

Pull Your Property Taxes Back Down to EarthHigher property tax bills have accompanied the rising market values of homes over the past several years. If your property taxes have reached the stratosphere, here are some tips to knock them back down to earth.

SERVICES

RECENT E-NEWSLETTERS

JULY 2023 Q & AQ: Is a gym membership a medical expense that can be paid by an HSA or FSA? A: Yes, but only if the membership was purchased for the sole purpose of affecting a structure or function of the body (such as a prescribed plan for physical therapy to treat an injury) or the sole purpose of treating a specific disease diagnosed by a physician (such as obesity, hypertension, or heart disease).

Identity Protection Pin (IP) From the IRSAn IP PIN is a six-digit number that help prevent someone from filing a tax return using your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). The IP PIN is known only to you and the IRS and helps verify your identity when you file your tax return. The IP PIN is valid for one year, so each January, you’ll need a newly-generated IP PIN. Most taxpayers can obtain an IP PIN by applying at IRS.gov/ getanippin. You must pass the identity proofing requirements. But if you can’t successfully validate your identity through online means, you may apply with Form 15227. After you’re assigned an IP PIN, it must be entered accurately on electronic and paper tax returns to avoid rejection and delays. Credit Scores

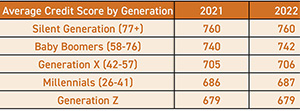

While there’s more than one credit scoring model, most credit score ranges are similar to the following: 800 to 850: Excellent; 740 to 799: Very good; 670 to 739: Good; 580 to 669: Fair; 300 to 579: Poor. How do you compare? Source: Experian data from September of each year; ages as of 2022

(516) 938-0491

(516) 938-0491

|